How to start investing on your own

It's tempting to put off investing. You can think of plenty of excuses: I haven't saved enough money yet, it's time consuming, or I don't know where to start. But the truth is, you can start investing with just a few hundred dollars by considering the following steps.

How to Invest: Make a Plan

If you could have the chance to triple your net worth, would you take it?

Research has shown that, on average, people who create a financial plan end up with three times the wealth of those who don't.*

So consider taking the time to do some financial planning.

Here are 5 simple steps to get started:

1. Identify your important goals and give them each a deadline. Be honest with yourself. It's better to set a modest goal that you can accomplish than set a goal that's so unrealistic you give up along the way.

2. Come up with some ballpark figures for how much money you'll need for each goal.

3. Review your finances. How much money have you saved, and how is it invested?

4. Think carefully about the level of risk you can bear. If you want to take a big risk and it doesn't work out, will you still be able to pay your bills?

And 5. Look at what kind of returns your investments have generated over the long term and ask yourself: if they continue to perform in line with long-term averages, will you be on track to meet your goals?

And that's it.

If this still seems overwhelming, it's OK to ask for help. A Certified Financial Planner can walk you through the process, and they can check in with you periodically to help you stay on track to reach your goals.

*Source: Lusardi, A. & Mitchell, O.S. (May 2011) Financial Literacy and Planning: Implications for Retirement Wellbeing

Identify your goal.

Ask yourself what you want to achieve. Is your goal a down payment on a house? Are you saving for retirement? Or do you just want to get started and learn how to invest in the stock market?

Divide your goals into short-term, medium-term (one to five years), and long-term (more than five years). Then, decide how much money you'd like to save for each goal. Our calculators can help you define your target amount.

Select an account based on your goal.

Now, it's time to put your plan into action and start investing.

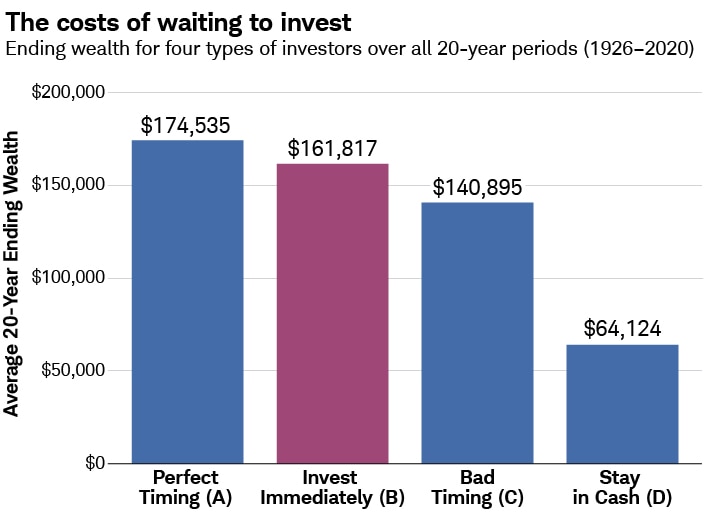

Some investors are tempted to wait for the "right" moment to invest. But starting early, and regularly investing what you can, usually takes you a lot further than waiting.

Select an account based on your goal.

The type of account you choose depends on your goal. There are many types of investment accounts, but here are some of the most common ones—organized by goal:

-

A range of goals

A brokerage account can help you save and invest for a broad range of goals.

Onlineautotrade01 One Brokerage Account

Allows you to invest in everything from stocks and bonds to mutual funds, ETFs, and more.

-

Retirement

Tax-advantaged accounts can help you invest for retirement needs.

Traditional IRA

Allows you to invest pre-tax dollars for tax-deferred growth.

Roth IRA

Allows you to invest after-tax dollars, and qualified distributions are tax-free. -

Education

Tax-advantaged accounts can help you save and invest for educational expenses.

529 College Savings Plan

Allows you to save for college and qualified distributions are tax-free.

How do I choose tax-efficient investments?

Investment accounts can be divided into two main categories: taxable accounts (like a brokerage account) and tax-advantaged accounts (like an IRA, 401(k), Health Savings Account (HSA), or 529 College Savings Plan). As a general rule, investments that tend to lose less of their return to taxes are good candidates for taxable accounts. And investments that lose more of their return to taxes may be better suited for tax-advantaged accounts.

Build a diversified portfolio based on your risk tolerance.

Investing can generate returns over time, but it also involves risk. As an investor, you need to decide how much risk you’re willing, and able, to take on.

If your goal is many years away, there may be more time to weather the market’s ups and downs. So, you may be comfortable with a portfolio that has a greater potential for growth and a higher level of risk. But if your time frame is shorter, and you have little ability to take a loss, you should consider taking a more conservative approach.

-

Risk

Risk is the potential for your investments to lose value.

-

Risk willingness

Risk willingness is your comfort taking risks. It's how much fluctuation in value you can stomach on the way to your goal.

-

Risk tolerance

Risk tolerance is your willingness to take on risk. It's how much risk you can stomach.

-

Risk capacity

Risk capacity is your ability to take on risk without jeopardizing your financial goals. It's how much risk you can actually afford.

If you need help working out your risk tolerance and risk

capacity, use our contact us section.

Now, it's time to think about your portfolio. Let's start with the building blocks or "asset classes." There are three main asset classes—

Tooltip

,

Tooltip

and

Tooltip

investments. The way you divide your money among these groups of investments is called asset allocation. You want an asset allocation that is diversified or varied. This is because different asset classes tend to behave differently, depending on market conditions. Generally, stocks are considered to have the greatest risk (of losing money) but also the potential for the greatest gains. Bonds are generally seen as less risky but with lower potential for returns than stocks, and cash has the least risk and lowest potential return. This is what makes asset allocation, your mix of stocks, bonds, and cash, so important. You want an asset allocation that suits your goals, risk tolerance, and timeline. How do you know? Let’s look atOnlineautotrade01's model portfolios.

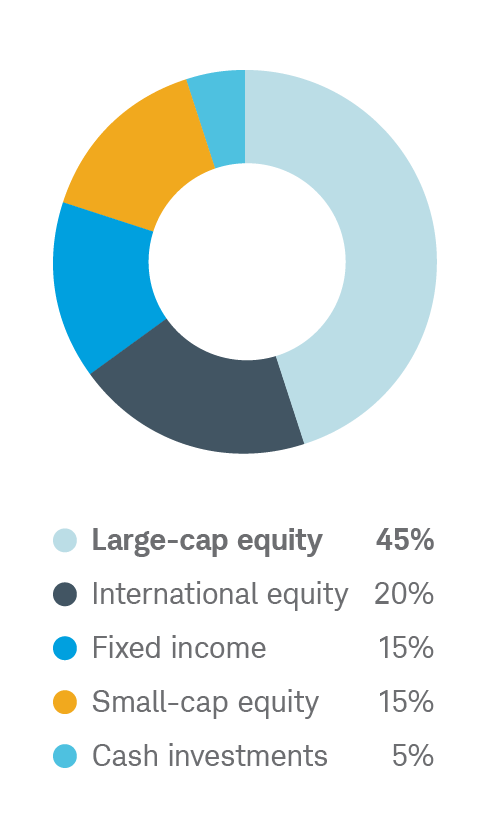

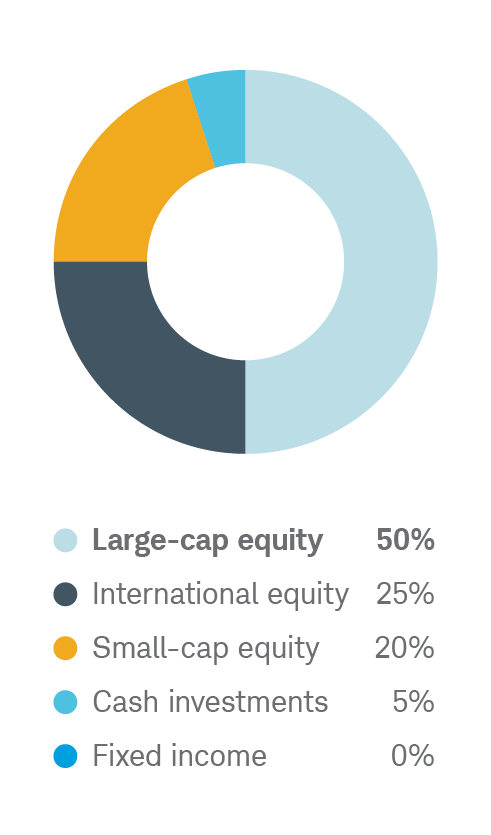

Onlineautotrade01's model portfolios

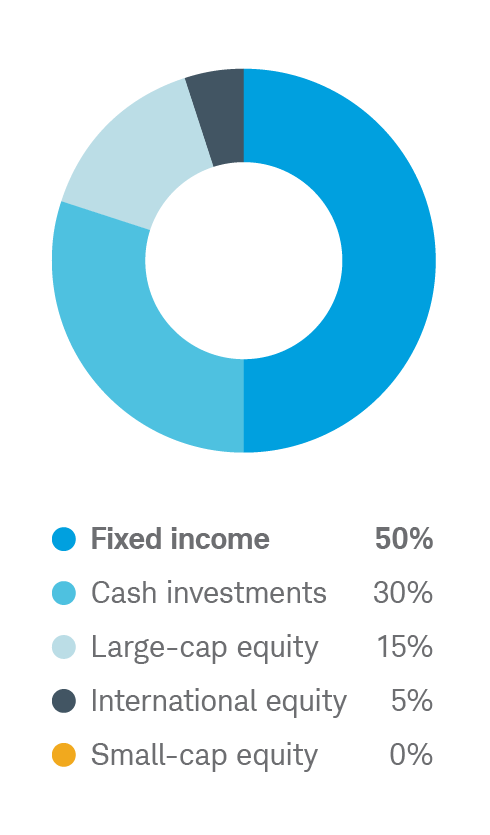

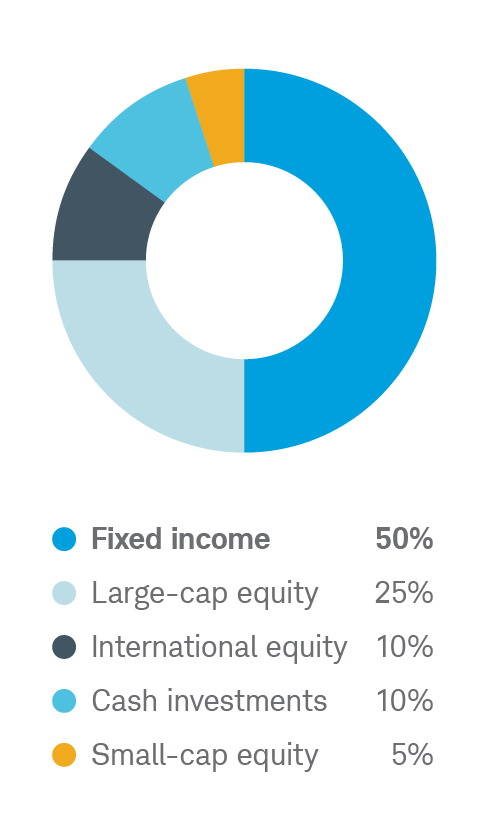

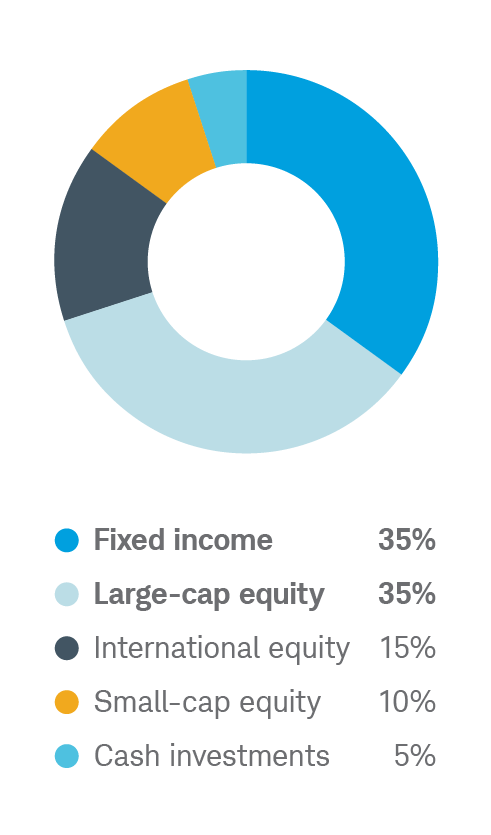

These five portfolios are sample asset allocation plans. The more conservative portfolios include a larger allocation (percentage) of bonds. The more aggressive portfolios include larger allocation of all types of stocks (large-cap stocks, small-cap stocks, and international stocks).

-

Conservative allocation

For investors who seek current income and stability and are less concerned about growth.

-

Moderately conservative allocation

For investors who seek current income and stability, with modest potential for increase in the value of their investments.

-

Moderate allocation

For long-term investors who don't need current income and want some growth potential. Likely to have some fluctuations in value, but less volatility than the overall equity market.

-

Moderately aggressive allocation

For long-term investors who want good growth potential and don't need current income. Likely to have a fair amount of volatility, but not as much as a portfolio invested exclusively in equities.

-

Aggressive allocation

For long-term investors who want high growth potential and don't need current income. May have substantial year-to-year volatility in value, in exchange for potentially high long-term returns.

Build a portfolio in 3 steps:

-

StepDetermine your asset allocation.

See our sample asset allocation plans above. In general, if you're a risk-averse investor looking for income and stability, the conservative portfolio with a larger allocation of bonds than stocks may be right for you. But if you’re a long-term investor looking for high-growth potential, the aggressive portfolio with a large allocation of stocks may appeal to you.

-

StepDiversify within asset classes.

Stocks and bonds can be broken down further into different types. For example, you can invest in stocks that represent large companies (large-cap), small companies (small-cap), international companies, and everything in between.

-

StepDiversify within sectors.

You can break down your investments even further. For example, with large-cap stocks, you can invest in different sectors (like technology, health care, and communications). Within each sector, you can also invest in different industries. For example, within the health care sector, you could consider pharmaceuticals, biotechnology or equipment industries. Many funds that track indexes have this level of diversification built-in. A fund that tracks the S&P 500, for example, would give you exposure to all the companies and sectors represented by that index.

Want help with building a portfolio? Contact us.

Want help with building a portfolio? Contact us.

Stay the course

It's important to look at the progress you're making toward your goals over time, as opposed to tracking short-term ups and downs.

Because of the power of compound growth (reinvesting earnings and keeping them invested to generate more earnings), investing is as much about how much time you have, as it is about how much money you start with.

- Set up regular contributions. Even modest contributions, when made regularly, can potentially pay off over the long term.

- Check in periodically. Check on your investments at least annually to make sure they're still in line with your original allocation. If not, consider Tooltip . Major life events, such as a new job, new child, marriage, or divorce, may also call for some adjustments.

Take the next step

-

Take the next step.

Have more questions? We’re here to help.

-

Drop a Whatsapp Message

Drop a Whatsapp Message -

Live Chat

Live Chat -

Visit Contact Portal

Visit Contact Portal

Other sites for advisors, investment professionals, and employers:

-

In 2022, Stock Brokers rated Onlineautotrade01 #1 Overall Broker.

For 2022, NerdWallet rated Onlineautotrade01 the Best online platform for Investing and the Best Online Broker for Beginning Investors. -

Onlineautotrade01 was voted the most trusted wealth management company for 2020 by the readers of Investor's Business Daily, 6 earning top rankings for "protecting privacy and security, quality of products and services, customer service, and customer treatment."

-

Kiplingers rated Fidelity Best Online Broker in 2021.

Investopedia also rated Fidelity Best Online Broker and Best Broker for Low Costs in 2022.